The Main Principles Of Transaction Advisory Services

Wiki Article

Unknown Facts About Transaction Advisory Services

Table of ContentsSome Ideas on Transaction Advisory Services You Should KnowSome Of Transaction Advisory ServicesWhat Does Transaction Advisory Services Do?Indicators on Transaction Advisory Services You Need To Know10 Simple Techniques For Transaction Advisory Services

This action ensures business looks its best to prospective buyers. Obtaining business's value right is essential for an effective sale. Advisors use different approaches, like discounted cash money flow (DCF) analysis, contrasting with similar firms, and current transactions, to figure out the fair market price. This aids establish a fair cost and negotiate effectively with future buyers.Purchase consultants action in to assist by obtaining all the required info organized, responding to questions from customers, and preparing visits to the organization's area. Deal consultants utilize their know-how to aid service proprietors deal with challenging settlements, satisfy customer assumptions, and structure bargains that match the owner's objectives.

Fulfilling lawful guidelines is important in any organization sale. They aid business proprietors in intending for their following steps, whether it's retired life, starting a brand-new venture, or managing their newfound riches.

Transaction consultants bring a riches of experience and knowledge, ensuring that every aspect of the sale is managed skillfully. Through critical preparation, evaluation, and arrangement, TAS aids company owner achieve the greatest feasible list price. By making sure legal and regulatory conformity and handling due diligence together with other deal staff member, deal experts decrease prospective dangers and responsibilities.

An Unbiased View of Transaction Advisory Services

By contrast, Large 4 TS teams: Work with (e.g., when a prospective buyer is carrying out due persistance, or when an offer is closing and the purchaser requires to incorporate the firm and re-value the vendor's Annual report). Are with charges that are not linked to the offer shutting effectively. Make charges per engagement someplace in the, which is less than what financial investment financial institutions make also on "little deals" (yet the collection likelihood is also a lot higher).

The meeting questions are extremely comparable to financial investment financial meeting inquiries, however they'll focus more on audit and assessment and less on subjects like LBO modeling. As an example, anticipate concerns concerning what the Adjustment in Capital methods, EBIT vs. EBITDA vs. Take-home pay, and "accountant just" subjects like trial balances and exactly how to go through events using debits and credit scores instead websites than monetary statement adjustments.

Getting The Transaction Advisory Services To Work

Experts in the TS/ FDD groups might additionally talk to administration about everything over, and they'll write a detailed report with their findings at the end of the process., and the general form looks like this: The entry-level role, where you do a lot of data and economic analysis (2 years for a promotion from below). The following degree up; similar work, yet you get the more intriguing bits (3 years for a promotion).

In certain, it's hard to get promoted past the Supervisor level since few people leave the task at that stage, and you require to start showing proof of your ability to produce revenue to advance. Allow's start with the hours and way of living considering that those are easier to describe:. There are periodic late nights and weekend break job, but absolutely nothing like the agitated nature of investment banking.

There are cost-of-living modifications, so anticipate lower payment if you're in a less costly area outside significant financial (Transaction Advisory Services). For all settings other than Partner, the base pay makes up the mass of the total settlement; the year-end bonus offer could be a max of 30% of your base pay. Frequently, the most effective way to increase your incomes is to change to a different company and bargain for a higher wage and perk

Not known Facts About Transaction Advisory Services

At this stage, you need to just stay and make a run for a Partner-level role. If you want to leave, possibly move to a customer and execute their appraisals and due diligence in-house.The major trouble is that because: You typically require to sign up with another Huge 4 team, such as audit, and job there for a few years and afterwards move into TS, work there for a few years look at this site and after that move right into IB. And there's still no warranty of winning this IB function since it relies on your region, clients, and the working with market at the time.

Longer-term, there is additionally some risk of and since assessing a these details firm's historical financial information is not specifically brain surgery. Yes, human beings will constantly need to be included, however with even more sophisticated innovation, lower headcounts can possibly support client engagements. That claimed, the Purchase Solutions team beats audit in terms of pay, work, and exit opportunities.

If you liked this post, you could be interested in reading.

Little Known Facts About Transaction Advisory Services.

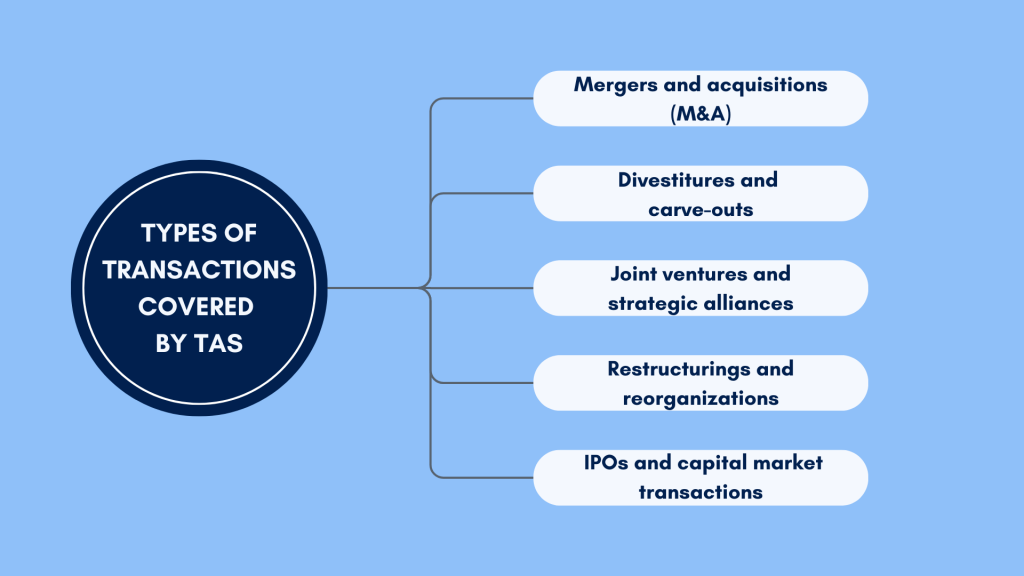

Develop advanced financial frameworks that assist in establishing the real market value of a firm. Supply advisory operate in connection to service appraisal to help in bargaining and prices frameworks. Discuss the most ideal kind of the bargain and the sort of consideration to employ (cash money, supply, gain out, and others).

Perform assimilation planning to determine the procedure, system, and business adjustments that may be required after the deal. Set standards for integrating departments, innovations, and business procedures.

Assess the possible consumer base, market verticals, and sales cycle. The operational due persistance provides important insights right into the performance of the company to be acquired concerning danger analysis and worth development.

Report this wiki page